Third-Party Risk Management

Third Party Risk Management Solution (TPRM): Checkmating your Business Risks With Confidence

The third-party risk management solution includes establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers, customers, and other sources worldwide that seek potential affiliations with your organisation.

CRI Group™ is launching a third-party compliance verification and certification program – 3PRM-Certified™ – across the Middle East, Europe and Asia region. This TPRM program can help organisations establish the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business.

3PRM™ SCOPE OF WORKS

Our 3PRM™ solution streamlines the third-party risk management process through scalability, and efficiencies – from third-party risk identification to assessment what sets us apart is that our 3PRM™ provides a comprehensive solution covering:

- Due Diligence

- Screening & Background Checks

- Regulatory Compliance

- Business Intelligence: Information Management

- Investigations: i.e. IP, Fraud, Conflict of Interest, etc

- Anti-bribery & Anti-Corruption (ABAC) Compliance

- Employee auditing training & education

- Monitoring & reporting

WHAT AREAS OF MONITORING 3PRM™ INCLUDE?

CRI Group 3PRMTM monitoring includes:

- Supplier & vendor information management

- Corporate & social responsibility compliance

- Supplier Risk Management

- IT vendor risk

- Performance measurement

- Contract risk management

WHAT ARE THE KEY FEATURES OF 3PRM™?

Our 3PRMTM suite of services can help you transform, implement & manage third-party risk management efforts. The key features of 3PRMTM includes

Diagnose, develop & enhance your program or function around:

- Governance & oversight

- Policies & standards

- Third-party inventory

- Risk approach & models

- TPRM processes & assessment frameworks

Profile third parties and assess their risk and controls leveraging your framework or ours, covering:

- Risk profiling

- Global onsite and remote-control assessment execution across all risk domains (e.g., cyber, resiliency, financial health and regulatory compliance)

- Analytics and reporting

Manage third-party risk processes across the relationship life cycle to provide:

- Pre-developed risk models, review criteria and reporting

- Risk profiling/third-party inventory

- End-to-end third-party oversight and governance

- Global onsite and remote-control assessment execution across all risk domains (e. g., cyber, resiliency, financial health and regulatory compliance)

SPECIFIC AREA ADDRESSED IN 3PRM™ ASSESSMENT

CRI Group™’s Third Party Risk Assessments are front-line tools used to ascertain whether an organisation has the proper policies and procedures in place to address all potential risks at the management, operations and financial levels, and simulates the likelihood of those risks occurring.

A 3PRM™ assessment includes a review of internal auditing procedures, compliance guidelines, performance criteria, internal controls, reporting processes and contractual requirements that are vital to foster a long-term positive outcome with the third-party provider when looking at the relationship from a cost-benefit standpoint.

Specific areas addressed in our 3PRM™ assessment include:

- Audit and supervision functions that assign clearly defined responsibilities within the organisation

- Business continuity plans that take into account natural disasters and third-party business closures

- Supply-chain alternatives that react and respond to every possible scenario, from regional events to currency fluctuations

- Jurisdictional considerations and affiliations with potential partners located in regions that may be prohibited by law

- Data and intellectual property protection, which includes customer privacy and information security considerations

- Anti-corruption and whistle-blower policies begin with staff education and extend to safe internal and external reporting mechanisms which are easily accessible to management and staff.

OUR RESOURCES FOR 3PRM™ SOLUTION

Our 3PRM™ resources include:

- International business verification

- Individual business interest search

- Personal profile on individual subjects

- Company profile on corporate entities

- Historical ownership analysis

- Identification of subsidiaries & connected parties

- Global & national criminality & regulatory records check

- World-check politically exposed person database

- International media research

- Country-specific databases that include litigation checks, law enforcement agencies & capital market, regulators

- Company background analysis

- Industry reputational assessment

- FCPA, UK Anti-Bribery & corruption risks databases

- Global terrorism check

- Global Financial authorities check

- Money laundering risk databases

- Financial reports

WHO NEED A 3PRM™ SOLUTION?

If your organisation requires any of the following within your compliance checklist, then you must consider a third-party risk management solution:

- Have a lack of visibility or understanding danger of the risks posed by your relationships with many types of third parties?

- Want greater visibility into third-party performance and risks?

- Need to improve operational costs, process, efficiencies, and organisational agility associated with your third-party relationships?

- Need to gain greater control over the related risks?

- Want to be confident that third parties are compliant with your business’ policies, as well as their own—based on government regulations and industry requirements?

WHY IS THIRD PARTY RISK MANAGEMENT A CRITICAL STEP FOR YOUR BUSINESS?

TPRM is especially critical when your business:

- Performs pre-merger & acquisition research

- Conducts due diligence

- Engages new clients

- Employs, contracts or retains foreign business partners

- Requires a consistent, audit-worthy anti-money laundering and anti-corruption compliance program

Implementing TPRM helps you avoid:

- Merging with an international business embroiled in behind-the-scenes legal battles

- Getting caught up in making procurement decisions involving the inappropriate influence of government officials who were slated to receive kickbacks

- Partnering with organisations that are potential credit risks, have claimed bankruptcy, have dissolved stated companies or are faced with debtor filings.

- Awarding work to an overseas contractor with absolutely no prior experience

- Affiliating with a contracting company owned by a politician with significant influence on future awards

WHY PARTNER WITH US?

Why partner with CRI Group™ for your third-party risk management solution?

- CRI™ has one of the largest, most experienced, and best-trained integrity due diligence teams globally.

- We have a flat structure which means that you will have direct access to senior members of staff throughout the due diligence process.

- Our multi-lingual teams have conducted assignments on thousands of subjects in over 80 countries, and we’re committed to maintaining and constantly evolving our global network.

- The unique 3PRM service we offer is flexible, and we will tailor our scope to address your concerns and risk areas, saving you time and money.

- Our extensive solutions include due diligence, employee pre and post-background screening, business intelligence, and compliance, facilitating any decision-making across your business, regardless of area or department.

Brochure on Third-Party Risk Management:

Brochure: 3PRMTM Solution

Third parties can help you drive your business success, but they leave you facing complex, ever-evolving risks!

Download BrochureRequest a 3PRM™ Quote

Please complete the form below to help us prepare the best and most accurate quote for you. We will get back to you within 48 working hours.

YOUR 3PRM™ EXPERTS

Zafar I. Anjum

Group CEO

Anab Gul

Head of Investigations

Zafar I. Anjum

GET IN TOUCH!

Zafar Anjum, Founder & Group CEO – CRI Group™

e: zanjum@crigroup.com | LinkedIn | t: +44 207 6861415 | m: +44 (0)7588 454959

Reach out for solutions in EMEA, APAC, Americas

Languages spoken: English, Urdu

Building a 30-year career in the areas of fraud prevention, protective integrity, security and compliance Mr. Zafar Anjum, MSc, CFE, CIS, MICA, Int. Dip. (Fin. Crime), CII, MIPI, MABI is a highly respected professional in his field. As a trusted authority in fraud prevention and securities among corporate clients, government agencies and industry groups, he is known for creating stable and secure networks across challenging global markets. With an impressive educational background coupled with his industry expertise, Mr. Zafar Anjum is often the first certified global investigator on the scene when multi-national EMEA corporations seek to close compliance or security gaps.

Starting his educational background in 1989 with his Bachelor of Arts Degree; he then went on to earn a Master of Science in Counter Fraud and Counter Corruption University of Portsmouth in the United Kingdom along with specialized knowledge and certification in: Fraud Investigations, Fraud and Financial Crimes, Corporate Fraud Control and Anti-Corruption. He also awarded with Distinction in Master of Fraud and Financial Crime and included in Executive Dean’s List of 2016 by Charles Sturt University, Australia. Both his training and business acumen give Mr. Zafar Anjum in depth precision when dealing with fraud risk management, security consultations, crime investigations, crisis management, risk governance, event security and strategic threat management for industry leaders seeking proactive long-term risk prevention.

His leadership abilities create strong collaborative relationships among prevention teams, crime investigators, government officials as well as business executives seeking dynamic solutions across international marketplaces. For industries needing large project management, safeguard testing and real-time compliance applications, Mr. Zafar Anjum is the assurance expert of choice for industry professionals.

Anab Gul

GET IN TOUCH!

Anab Gul

Head of Investigations & Intelligence

Europe, the Middle East, and Africa- EMEA

Anab Gul is the head of investigations and a specialized expert in business intelligence for over 15 years. While serving CRI™ she spearheads due diligence, compliance operations, third party risk management and employee background screening thereby ensuring a secure business environment and brand protection for our clientele globally in various sectors.

Anab has focused her efforts towards providing regulatory advice and help clients detect, understand, and manage risks pertaining to vendor management, mergers and acquisitions, new market entry and specially employee vetting where she has facilitated over 20000 recruiters internationally in the last decade and enabled them to make evidence-based selection of qualified candidates.

She is well-equipped in conducting conflict of interest investigations specially when our clients are recruiting directors for C-suite, her investigations have empowered innumerable corporations to hold all stakeholders to the highest ethical standards.

Education: Master’s in political science specialised in International Relations (IR)

Certifications: GDPR Certified, PBSA certified, Anti bribery & Anti-Corruption Certified

Expertise Highlights:

1. Due Diligence & Compliance Programs

2. Third party & Vendor Screening

3. Risk Management

4. Pre-Employment Screening

5. Insurance Fraud Investigations

e: anab.gul@crigroup.com | LinkedIn | t: +92 511 1188 8400 | m: +92 300-5012082

Languages: English

RELATED SERVICES

INTELLECTUAL PROPERTY INVESTIGATIONS

Intellectual Property can be a business's most valuable asset. So when outside parties threaten to steal your ideas, copy your products or disrupt your marketing channels, corrective action on your part can become tedious, time-consuming...

Read More

BACKGROUND INVESTIGATIONS

Background screening investigations are critical to any company’s success because working with qualified, honest, and hard-working employees and other businesses is an integral part of thriving in the business community. What you don’t know can...

Read More

DUE DILIGENCE 360°

Due diligence on potential business partners, when adding a new vendor or even when hiring a new employee is vital to confirm the legitimacy and reduce the risks associated with such professional relationships. Global integrity...

Read MoreSTAY UPDATED

GET INDUSTRY NEWS DELIVERED TO YOUR INBOX

Sign up for risk management, compliance, background investigations, business intelligence and due diligence-related news, events and publications.

‘Tis time for New Hopes, Dreams & New Year Resolutions!

Running a new start-up or even a mature and successful business setup is no mean task. Hopefully, you have safely weathered all the storms that came your way in 2022: transitioning from the unprecedented pandemic;...

Read More

PBSA Annual Conference 2024

Mark Your Calendars for the PBSA Annual Conference 2024 this September in Boston! We are thrilled to announce that Corporate Research and Investigations (CRI Group™) will be proudly sponsoring and exhibiting at the highly anticipated...

Read More

CRI Group™ Accredited by PBSA®| Background Screening Credentialing Council

Corporate Research and Investigations Limited (CRI Group™) ACHIEVES BACKGROUND SCREENING CREDENTIALING COUNCIL ACCREDITATION RALEIGH, N.C., DATE – The Professional Background Screening Association (PBSA®) Background Screening Credentialing Council (BSCC) announced today that Corporate Research and Investigations...

Read More

SHRM GCC HR SUMMIT – DUBAI 2024

Mark Your Calendars for the SHRM GCC HR SUMMIT this June 5th & 6th! We are thrilled to announce that Corporate Research and Investigations (CRI Group™) will be proudly sponsoring and exhibiting at the highly...

Read More

Economic Crime Act 2024: Impact on Your Business

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) marks a pivotal moment in the fight against financial crime, bolstering the UK's commitment to transparency and accountability. Expanding upon the groundwork established by the Economic...

Read More

Navigating the Changes: ISO 37001:2016/Amd 1:2024 Explained

In today's business landscape, where integrity, sustainability, and compliance are paramount, ISO 37001:2016 stands out as a crucial standard for promoting anti-bribery management systems. Positioned at the heart of ethics and due diligence, this standard...

Read More

Executive Director Appointment at Corporate Research and Investigations Limited: A New Era Begins

London, Friday, 17 May 2024 – Corporate Research and Investigations Limited (CRI Group™), a global leader in corporate research and investigation services, is thrilled to announce the appointment of Mr. Tamseel Ahmed as our new...

Read More

Significance of Due Diligence in Economic Crime & Corporate Transparency Act Compliance

The Importance of Due Diligence in Demonstrating Compliance with The Economic Crime and Corporate Transparency Act Corporate fraud in the UK has been a growing concern, with statistics reflecting the extent of the issue. According...

Read More

The Removal of the UAE from the FATF’s grey list in February 2024

The UAE's Victory – A New Dawn in Regulatory Compliance and Investment Opportunities In a landmark achievement for the United Arab Emirates (UAE), the Financial Action Task Force (FATF), the global watchdog for anti-money laundering...

Read More

ACFE Fraud Conference Middle East 2024

Mark your calendars for ACFE Fraud Conference Middle East this Feb 2024. As the Platinum Sponsor, we transcend the role of mere attendees; we are curators of an ensemble featuring global virtuosos! Brace yourself for...

Read More

HR WORLD SUMMIT – RIYADH 2024

Mark Your Calendars for the HR World Summit this Feb 15, 2024! We are thrilled to announce that Corporate Research and Investigations (CRI Group™) will be proudly sponsoring and exhibiting at the highly anticipated HR...

Read More

Kuwait’s Degree Crackdown: A Wake-Up Call for Employee Screening

Kuwait's Degree Crackdown: A Wake-Up Call for Employee Screening – Act Now or Risk Consequences Kuwait's proactive steps to validate the academic qualifications of its government employees signals a broader trend in addressing the challenges...

Read More

Setting New Standards in Fraud Prevention – CRI Group™ Joins ACFE Middle East Conference 2024

In an era where financial fraud poses a growing threat to global economies, CRI Group™ steps up as a beacon of innovation and leadership. We are excited to announce our platinum sponsorship at the prestigious...

Read More

The Future of Business: 2024 Corporate Strategy and Trend Analysis

In 2024, businesses across the UK, EU, and US are prioritizing strict compliance, particularly in anti-corruption and anti-bribery measures. The UK leads with its robust Bribery Act and a cultural shift towards integrity, as businesses...

Read More

2023 Review: Explosive Insights into Compliance, Due Diligence, and Background Screening!

As we usher in the year 2023, the fields of compliance, due diligence, and background screening continue to evolve rapidly. These essential components of risk management have never been more critical, given the dynamic global...

Read More

Tips for Enhancing Your Supply Chain Due Diligence

Supply chains, in today's digital landscape, have grown intricate and deeply interwoven with third-party entities. While this interconnectedness brings advantages, it also amplifies potential security breaches. The vulnerability of supply chains to cyber threats has...

Read More

The 2023 International Anti-Corruption Day (IACD) – Forge a Future Free from Fraud

Corruption, a multifaceted issue impacting social, political, and economic realms, poses a significant threat to countries worldwide. Its detrimental effects are far-reaching, undermining democratic institutions, impeding economic growth, and leading to governmental instability. This phenomenon...

Read More

The UK 2023 Economic Crime and Corporate Transparency Act

The UK 2023 Economic Crime and Corporate Transparency Act: A Guide for Businesses with CRI Group™ Solutions On October 26, 2023, the Economic Crime and Corporate Transparency Act received royal assent in the United Kingdom,...

Read More

SHRM MENA23 NOV 1-2, 2023 | ATLANTIS, THE PALM, DUBAI

Mark your calendars for SHRM MENA 2023 Dubai This November 1st & 2nd! Corporate Research and Investigations is a proud sponsor & exhibitor at the upcoming SHRM MENA Annual Conference and EXPO being held...

Read More

The Consequences of Neglecting Background Screening and Compliance in the UK

In the ever-evolving business landscape in the United Kingdom, ensuring a trustworthy and secure workforce is essential. In 2008, the UK government took a significant step towards achieving this goal by introducing the Employment Background...

Read More

HR SUMMIT & EXPO HRSE – DXB 2023

Mark your calendars for HR Summit & Expo (HRSE) KSA This October 24th & 25th! Corporate Research and Investigations is a proud sponsor & exhibitor at the upcoming HR Summit & Expo (HRSE) being...

Read More

CRI Group™ Unveils Cutting-Edge Pre-Employment Screening Solutions at PBSA 2023

Empowering Saudi Arabia's Workforce: CRI Group™ Unveils Cutting-Edge Pre-Employment Screening Solutions at PBSA 2023 In the heart of the Middle East, the Kingdom of Saudi Arabia stands as a dynamic symbol of rapid evolution and...

Read More

How to Achieve Know Your Customer (KYC) Compliance

Over the last ten years, financial institutions worldwide, spanning the U.S., Europe, APAC, and the Middle East, have faced a staggering $26 billion in penalties. These fines were meted out for lapses in anti-money laundering...

Read More

British American Tobacco to Pay $629 Million in Fines for N. Korean Tobacco Sales

The recent staggering case involving British American Tobacco (BAT) and its subsidiary, BAT Marketing Singapore (BATMS), reverberates across the corporate world, serving as a stark reminder of the vital imperative of robust compliance, unwavering fraud...

Read More

$114M Nursing Diploma Scandal: How Thousands of Nurses Got Licensed with Fake Degrees

The recent nursing diploma scandal has exposed a dark underbelly of the healthcare industry—untrained individuals posing as registered nurses and licensed practical nurses due to the proliferation of fake degrees and fraudulent credentials. This alarming...

Read More

PBSA Annual Conference 2023

Celebrating 20 Years of PBSA: A Spectacular Event in Grapevine, TX The Professional Background Screening Association (PBSA) is gearing up to celebrate its momentous 20-year anniversary at the 2023 PBSA Annual Conference in Grapevine, TX....

Read More

The Rise in Insurance Fraud by Individuals

Insurance fraud is a growing concern worldwide, with individuals resorting to elaborate schemes to deceive insurers and cash in on substantial payouts. Among the many alarming cases that have come to light, one particular incident...

Read More

Employee Background Screening is Taking the Middle East Region by Storm!

The success of any organization lies in its people—the driving force behind innovation, productivity, and growth. Hiring the right individuals who not only possess the required skills but also align with the organization's values and...

Read More

The DOJ’s Updated Compliance Guidelines: What Every Business Must Know or Face Serious Consequences!

Compliance is the lifeblood of your business, and the U.S. Department of Justice (DOJ) has just released game-changing guidelines that can make or break your success. Ignorance is no longer an excuse! In this blog...

Read More

EU Shocks Global Supply Chains with Mandatory Human Rights Due Diligence Directive

The European Union has released a groundbreaking directive that will transform global supply chains forever. This directive will require large EU companies and non-European companies conducting significant business in Europe to assess and address their...

Read More

Discover the Importance of Due Diligence

The Shocking Trevor Milton/Nikola Corporation Merger Scandal Exposed! Mergers and acquisitions can be a double-edged sword, and the case of Trevor Milton and Nikola serves as a shocking example. A federal jury found Milton guilty...

Read More

Drake & Scull International (DSI) Plunges $857.5 Million Due to Employee Background Check Failure

What Businesses Can Learn from This Case? Employee background checking is an indispensable process for organizations, upholding integrity, ensuring trustworthiness, and validating qualifications. Statistics reveal that background check failures can have severe financial repercussions for...

Read More

Fraud Prevention and Investigations: A Powerful Tool for Mitigating Business Risks

It’s no secret that business risks come in all shapes and sizes, but few of them can have as devastating an effect on the long-term health and success of a business than fraud. Fraud prevention...

Read More

Reducing Disruptions in Pharma Supply Chain

How Third-Party Risk Management Can Help The pharmaceutical supply chain is complex, with numerous suppliers and vendors involved in the process of bringing a drug to market. With the rising costs and regulatory challenges, the...

Read More

HR Summit & Job Fair 2023 Exhibition – Islamabad

Corporate Research & Investigations CRI Group™ cordially invites you to attend Pakistan’s HR Summit being held on May 27th, 2023, at Pak-China Friendship Center Islamabad! We believe Pre-Employment Screening & Background Verification concepts are an inescapable recruitment...

Read More

HR Summit & Expo (HRSE) KSA 19 – 20 June 2023 – Riyadh

Corporate Research and Investigations is a proud sponsor & exhibitor at the upcoming HR Summit & Expo (HRSE) being held in Riyadh this June 2023. We cordially invite you to visit us at the summit...

Read More

Ultimate Employer’s Guide to Pre-Employment Background Checks

McLane Foodservice paid $40,000 to settle the lawsuit due to a lack of pre-employment background checks on job applicants. Yes, that's right! In 2017, McLane Foodservice, a Texas-based company, made headlines after settling a discrimination...

Read More

Pre-Employment Background Screening: The Importance of Human Due Diligence

In 2017, Amazon made a strategic decision to acquire Whole Foods, a move that promised to expand the e-commerce giant's reach into the grocery space. But what looked good on paper quickly turned into a...

Read More

UAE Imposes Fines on Non-Compliant Corporations: Is Your Business At Risk?

UAE Businesses Beware: AED 22.6 Million in Fines for Non-Compliance with Anti-Money Laundering and Terrorism Financing Regulations! That's right, the UAE's Ministry of Economy has cracked down on 29 companies operating in the designated non-financial...

Read More

CRI Group launches ESG Due Diligence to cut your Environmental, Social & Governance risks

The CRI Group's 3PRM™ (Third-Party Risk Management Program) has launched its ESG Due Diligence program that defines, detects, and improves Environmental, Social, and Governance (ESG) risks for organisations. Corporate Research and Investigations Limited's ESG Due...

Read More

ACFE FRAUD CONFERENCE MIDDLE EAST 8 – 9 MAY 2023 | DUBAI

As a Platinum Sponsor of the conference, we aim to showcase our expertise to fraud prevention professionals and demonstrate our commitment to leading with diligence and promoting ethical business practices in the region.

Read More

The CRI Group™ enters Saudi Arabia

We are now open in the holy state of Saudi Arabia The CRI Group™, a global leader in Anti-Corruption, Compliance, Fraud Risk Investigations, and Third-Party Risk Management, has extended its reach into Riyadh, Kingdom of...

Read More

FIFA World Cup highlights Africa’s sad story of Corruption

The action on the football field at the recently concluded 2022 FIFA World Cup in Qatar bore the strong imprint of African migration -- and the stink of corruption. France’s Kylian Mbappe, one of the...

Read More

Think Employee Background Checks are a waste of time? Think again!

So you think an Employee Background Check is a waste of your time? Here are some alarming stories for you: A CANDIDATE WHO HID HIS DEPLORABLE BACKGROUND One of our clients had interviewed an impressive...

Read More

CRI celebrates the 2022 International Anti-Corruption Day

The world today is plagued with some of the biggest issues of all time. The plague of corruption is intertwined in most of them, threatening the prosperity and stability of many countries. Corruption negatively impacts several...

Read More

Intellectual Property: What do the statistics indicate?

Intellectual Property (IP) is defined as the creation of the mind that includes inventions, patents, designs, any type of art, etc. The primary purpose of establishing intellectual property rights is to foster an environment that...

Read More

Know your Swiss Corporate Reporting and Due Diligence Obligations

Switzerland has introduced new Corporate Reporting and Due Diligence obligations in connection with conflict minerals and child labour to improve human rights protections around the world. Switzerland is following international trends and regulations for non-financial...

Read More

Can Business Intelligence really empower your business?

An indispensable asset to any organisation, Business intelligence (BI) comprises the strategies and technologies that can be used to make on-the-spot decisions that increase revenue, improve productivity, and accelerate growth. This is done through data...

Read More

The new Norwegian Transparency Act: Here’s what you need to know

The Norwegian Transparency Act entered into force on 1 July 2022, obliging large and mid-size companies to conduct fundamental human rights and decent working conditions due diligence throughout their supply chain and with their business...

Read More

The new Dutch Child Labour Due Diligence Law: Some FAQs

On November 13, 2019, the new Dutch Child Labour Due Diligence Law was published in the Dutch Government Gazette. It introduces a duty of care for companies to prevent the supply of goods or services...

Read More

How does Human Rights Due Diligence Legislation in EU affect Asia

With the EU Due Diligence Legislation in play, the concept of mandatory human rights due diligence for companies is gaining momentum among governments and businesses in Europe. So how does this legislation matter? In terms...

Read More

Case Study: Lessons Learned from Employee Fraud

The most popular type of fraud is misappropriation of assets, including theft of cash and inventories. The motivation to commit fraud include a lack of understanding about fraud behaviour, opportunity to commit fraud and lifestyle...

Read More

What’s Your Plan of Action for Mandatory Due Diligence?

There is growing momentum among governments all over the world that calls for Mandatory Due Diligence. This requires companies to undertake human rights and environmental due diligence. We now have the French Duty of Vigilance...

Read More

EU: Can IP Infringements Cost You Your Life?

The Intellectual Property Commission estimates that IP infringements in the form of counterfeit goods, trade secret theft, and pirated software costs the US economy $225 billion to $600 billion. Following the outbreak of the COVID-19...

Read More

The mandatory Corporate Sustainability Due Diligence: How to comply?

The European Commission on 23 February 2022 adopted a long-awaited proposal for a Directive on mandatory corporate sustainability due diligence for widely-defined specified “companies”. The proposals cover obligations throughout the value chain and also attach...

Read More

Employee Background Screening: Fake CV Lands a Top NHS Job… Are Your Employees Telling the Truth?

Is Employee Background Screening as critical as they make it out to be? A former builder who faked his CV to land a series of top NHS jobs has finally been forced to pay the full...

Read More

IP infringement: The Intellectual Property and Youth Scoreboard 2022 is ut!

IP infringement by way of buying counterfeit goods online and accessing digital content from illegal sources, intentionally or by accident, remain a common practise among youth, says the 2022 edition of the Intellectual Property and...

Read More

Employee Background Screening FAQs – PART III: Conflict of Interest Checks & FACIS Searches

This three-part series of articles looks at employee background screening FAQs. How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling...

Read More

CRI Group™ Announces Webinars on Key Aspects of Due Diligence Investigations

The CRI Group™ is hosting a series of webinars on Due Diligence Investigations. The insightful webinars will help you go deep into crucial aspects of Due Diligence Investigations with lessons learned by industry leaders in...

Read More

Employee Background Screening FAQs – PART II: Pre-Employment Check

This three-part series of articles looks at employee background screening FAQs. How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling...

Read More

Supply Chain Due Diligence Act: New Risk Management & Reporting Duties for German Businesses

This article looks at the Supply Chain Due Diligence Act (LkSG) that applies to companies operating or trading in Germany and will enter into force on 1 January 2023. The new German law, known as...

Read More

FREE eBook | Supply Chain Due Diligence Act (LkSG)

In January 2023 a new German law, known as the Supply Chain Due Diligence Act (LkSG, short for Lieferkettensorgfaltspflichtengesetz in German), becomes effective and applies to companies operating or trading in Germany. This eBook looks...

Read More

Employee Background Screening FAQs – PART I: What, Why and Who?

How do you know the candidate you just offered a role to is the ideal candidate, when it comes to Employee Background Screening? Are you 100% sure that everything they’re telling you is the truth?...

Read More

WEBINAR RECORDING | “Remote Work & Other Trends Shaping Workplace Cultures”

CRI Group™ hosted a free webinar on August 31st. Our intention was to be able to provide resources on workplace cultures in organisations around the globe that will aid them in expansion and an positive...

Read More

IPR Infringement Report Says IP Infringement is Getting Worse!

Intellectual property can be a business’s most valuable asset. So when outside parties threaten to steal your ideas, copy your products or disrupt your marketing channels, corrective action on your part can become tedious, time-consuming...

Read More

Infringement of Intellectual Property Rights

Suppose you suspect that your intellectual property (IP) rights have been infringed. In that case, CRI Group’s Intellectual Property Investigations team helps companies identify threats to IP and confidential information internally and throughout their supply chain,...

Read More

UAE Central Bank Issues New Anti-Money Laundering Guide on Dealing with Politically Exposed Persons

The Central Bank of the UAE (CBUAE) has issued a new anti-money laundering (AML) guide and combatting the financing of terrorism (AML/CFT) for licenced financial institutions (LFIs) on risks related to politically exposed persons (PEPs),...

Read More

Let’s Celebrate Human Resources Appreciation Week

Being in Human Resources (HR) can be difficult to handle. After all, the HR department plays an integral role in ensuring the success of organisations by nurturing and developing human capital. However, they do not...

Read More

Background Investigations: One-on-one interview with Zafar Anjum

Background Investigations: One-on-one Interview with Zafar Anjum Having dedicated his career to a background investigation, fraud prevention, protective integrity, security and compliance, Zafar Anjum is a distinguished and highly respected professional in his field. As...

Read More

What is Continuous Background Screening?

For decades, pre-employment background screening has been helping organisations hire the right candidates for the right roles. These checks hold good till a candidate gets on board. But what if one of your existing employees...

Read More

Seven Types of Business Risk You may Want to Address in Your Company

Running a business takes hard work and while success - customers, revenue and satisfaction - is the ultimate goal, all businesses come with risks which could stop you from achieving your goals. That’s why business...

Read More

FCRA: Risk Assessment and Financial Crime

A thorough understanding of its financial crime risks is key if a firm is to apply proportionate systems and controls. The following are self-assessment questions to help you implement an efficient risk assessment to mitigate...

Read More

What is BS7858 Standard? And Why it is Important?

What is BS 7858 Standard? The British Standards Institution (BSI) has recently revised the British Standard for Security Screening of Security Personnel (BS7858:2004). The new code of practice BS7858:2019 came into effect at the end...

Read More

Review and Reassess Your Organisation’s Third-Party Relationships

Is it the Time to Review and Reassess Your Third-Party Relationships? The global pandemic is rattling economies worldwide, disrupting supply chains, interrupting production, wreaking havoc on industry sectors and shuttering businesses; this impacts third-party relationships...

Read More

CRI Group™ Celebrates 32 Years

May 17th of 2022 marks the 32nd anniversary of the establishment of Corporate Research and Investigations (CRI Group™). Yay, for us! From the very beginning, the CRI Group™ has been dedicated to safeguarding organisations and...

Read More

WEBINAR | Compliance and Adequate Due Diligence for Third-Party Risk Managements

Building a Culture of Compliance and Trust Through ISO 37301:2021 CMS: Compliance adequate Due Diligence for Third-Party Risk Management – corporate compliance program Free Webinar | 4 August 2022 | 2 pm – 3 pm...

Read More

CxO Global Forum Network welcomes Nilofar A.Gardezi

Corporate Research and Investigations Limited (CRI Group™) is happy to invite you to watch this exclusive talk with CXO Rendezvous. Our HRBP & Associate Director, Nilofar, sat with CxO Global Forum at the Rendezvous show...

Read More

Risk Management & What can Business Intelligence do?

Businesses must manage risks because they can frequently prevent or minimize the financial, political, social, and cultural ramifications associated with them. Risk management is an effective tool to tackle uncertainties in the probability of an...

Read More

What is Fraud Investigation?

Fraud is one of the biggest and most damaging risks businesses face. The headlines are full of organisations both in the private and public sectors affected by fraud, irregularity or other wrongdoing – either as...

Read More

Employee Fraud: Why are Human Factors so Important in Risk Management?

When any fraud, including employee fraud, is discovered, it's usually by surprise. That's because most of us aren't used to looking for criminal behaviour inside our organisation. We trust our employees and co-workers, and we...

Read More

Supply chain due diligence act will enter into force on 1 January 2023, are you ready?

The German Parliament ("Bundestag") adopted the "Act on Corporate Due Diligence in Supply Chains" (Supply Chain Due Diligence Act – "Act" or "LkSG"), and the act will enter into force on 1 January 2023. Originally...

Read More

CRI Group™ is Attending 2022 ACC Annual Conference

Corporate Research and Investigations Limited (CRI Group™) is delighted to unveil our place at the 2022 ACC (Association of Corporate Counsel) annual conference as a sponsor and exhibitor. The ACC Annual Meeting at Las Vegas on October...

Read More

Thank You for Visiting Us at Trade Winds

2022 Trade Winds was a success... Thank you for visiting us at Trade Winds! Corporate Research and Investigations Limited (CRI Group™) was delighted to take its place at the 2022 Trade Winds As the largest annual...

Read More

7 Reasons Why You Should Perform Global Integrity Due Diligence Investigations

Why should you perform global integrity due diligence investigations? Global integrity due diligence investigations provides your business with the critical information it needs to make sound decisions regarding mergers and acquisitions, strategic partnerships, and the...

Read More

Anti-Money Laundering (AML) Services, Why Do You Need it?

There are many advantages to outsourcing portions of your Anti-Money Laundering (AML) compliance program to CRI Group™ CRI™ Anti-money laundering (AML) advisory services help analyse systems and develop effective solutions that reduce your company’s risk...

Read More

External Protection: Due Diligence Investigations

Due Diligence Investigations Can Give You External Protection Due Diligence investigations involve thoroughly identifying, evaluating and verifying all available information on a person, company or entity. By conducting a comprehensive due diligence investigation through a...

Read More

We (CRI Group™) Got a New Office in Estonia

CRI Group™ Opens Office in Estonia Corporate Research and Investigations Limited (CRI Group™), a global leader in Risk Management and Compliance solutions, announced today the opening of its offices in Estonia (Corporate Research and Investigations...

Read More

Why Partner with CRI Group™? We’re Glad You Asked

Since 1990, Corporate Research and Investigations Limited "CRI Group™" has safeguarded businesses from fraud and corruption, providing insurance fraud investigations, employee background screening, investigative due diligence, third-party risk management, compliance and other professional investigative research...

Read More

2022 Investigations & White-Collar Crime POWER PLAYERS Issue Is Out Now!

2022 Investigations & White-Collar Crime 2022 Investigations & White-Collar Crime Power Players issue is out. Corporate Research and Investigations Limited were featured in this year Financier Worldwide’s Power Players issue. In this edition, CRI® Group’s...

Read More

Stop Gender Based Violence: Incorporate Risk Assessment Into Your Due Diligence Process

Gender Based Violence: Incorporate Risk Assessment Into Your Due Diligence Process Gender based violence is constantly on the rise - research by the UN Women, “The economic costs of violence against women” suggests that the cost of violence...

Read More

Our CEO has been Invited to Speak at The Fraud Outlook 2022 Webinar

The Fraud Outlook 2022 Webinar Corporate Research and Investigations Limited (CRI Group™) is delighted to unveil our place at The Fraud Outlook 2022 Webinar, which is being held from 12:00 to 13:00 on Wednesday 23...

Read More

New Legislation to Tackle Global Economic Crime

The Government Has Brought Forward New Legislation (Economic Crime - Transparency and Enforcement- Bill) To Tackle Economic Crime And Improve Corporate Transparency The Economic Crime (Transparency and Enforcement) Bill has been introduced in Parliament this...

Read More

CRI™ Named Certified Provider by HRO Today Association

CRI Group™ has been approved by the HRO Today Association as a Certified Provider to the human resources services industry. CRI Group™ completed a rigorous audit process and “demonstrated a high level of accountability of...

Read More

The Global Business Climate is Changing. So Are Your Third-Party Partners

The current business climate requires a review and reassessment of your organization's third-party relationships. The global pandemic is rattling economies worldwide, disrupting supply chains, interrupting production, wreaking havoc on industry sectors and shuttering businesses. It's...

Read More

2021 CPI Overview is Out Now!

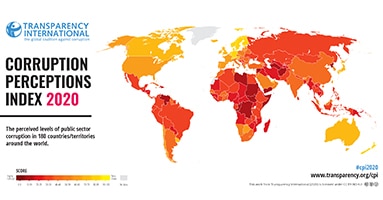

The newly published Transparency International’s Corruption Perception Index (CPI 2021) is out. This year’s Corruption Perceptions Index (CPI) reveals that corruption levels are at a worldwide standstill. The CPI ranks 180 countries and territories around the...

Read More

How to Protect Your IP with Brand Protection Investigations?

Intellectual Property (IP) is an exclusive right of the brand owner. This property includes intangible creations of the brand owners' human intellect; therefore, the brand owners are lawful copyright or trademark owners. However, when unscrupulous individuals...

Read More

What are Cultural Barriers in Background Screening Across the Globe?

Background Screening Cultural Barriers Background screening cultural barriers: the COVID-19 pandemic has accelerated the expansion in wireless connectivity between personal and working communities around the globe; however, this has not come without the trials in...

Read More

Ensuring Compliance and Quality Hires Drives the Need for Background Checks

A recent CRI Group™ survey of business leaders finds that enhanced regulatory compliance, ensuring quality hires and maintaining workplace safety and security were considered the top benefits of conducting background checks. Key considerations for engaging a...

Read More

Personal Due Diligence, Tips You Need to Know

In the business world, due diligence refers to the investigation and steps were taken by organisations to satisfy all legal requirements before buying or selling products/ services or entering into a contract or a financial...

Read More

Managing HR through COVID-19 in 4 Simple Steps

Managing HR through COVID-19 Managing HR through COVID-19, here are the four simple steps. COVID-19 continues to affect communities on every continent. This global crisis called for fresh due diligence and risk management review of...

Read More

Employee Screening During COVID-19: Doesn’t Have to be Complicated

Employee Screening During COVID-19 Made Simple Employee Screening During COVID-19. Unsurprisingly, the virus has had a massive impact on businesses, and the recruitment industry is certainly not immune to that. Companies adapted quickly to survive,...

Read More

An Open End-of-Year Appreciation Letter

An Open End-of-Year Appreciation Letter As the end of the year draws near, we would like to take this opportunity to thank all of you for a fantastic year. The success of the CRI™ Group...

Read More

Happy holidays!

As we move into 2022 and seek new opportunities, know that CRI™ is here, as your partner, to help you by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers, employees...

Read More

Financial Crime Policies and Procedures: examples of Good and Poor Practice

The principal catalyst of economic crime (also known as financial crime) is monetary gain. However, economic crime has a devasting effect on individuals and communities. When associated with organised crime and terrorist financing, it threatens...

Read More

UAE Rule: ‘Good Conduct & Behavior’

UAE Good Conduct & Behaviour: CRI Group™ urges all UAE organisations to implement thorough background screening under the UAE Good Conduct & Behaviour rule Those applying for UAE employment visas need to obtain the UAE "Good...

Read More

CRI™ Celebrates 2021 International Anti-Corruption Day

CRI™ celebrates 2021 International Anti-Corruption Day: Organisations are urged to unite on December 9th for International Anti-Corruption Day Corruption is the single greatest obstacle to economic and social development around the world. According to the...

Read More

CRI™ Opens Office in Turkey

CRI Group™ Opens Office in Turkey Corporate Research and Investigations Limited (CRI Group™), a global leader in Risk Management and Compliance solutions, announced today the opening of its offices in Turkey (Corporate Research and Investigations...

Read More

Towards a Fraud-free future: CRI™ Celebrates 2021 Fraud Week

Towards a Fraud-free Future CRI Group™ is proud to be celebrating International Fraud awareness week 2021. Alternatively known as Fraud Week for short, this day proves to be a critical effort to put a spotlight...

Read More

Do You Know What are the Measures to Implement to Prevent Fraud?

Measures to Fight Fraud: The Implementation Measures to fight fraud. What are measures every organization must implement to prevent fraud? Reporting fraud is crucial for any organization to do as it aids in not only...

Read More

2021 Fraud Week: Prevention is Key

The 2021 Fraud Week: Prevention is Key! Every year, for one week in November, organisations around the world embrace a movement aimed to minimise and prevent fraud and corruption. International Fraud Awareness Week (“Fraud Week,” for...

Read More

50th UAE National Day 2021

50th UAE National Day 2021 50th UAE National Day 2021. Today is the UAE's National Day, which coincides with the country's Golden Jubilee, marking 50 years since the founding of the Emirates, and we couldn't...

Read More

CRI™ Group’s Plans for International Anti-Corruption Day

International Anti Corruption Day 2021 International Anti Corruption Day 2021 is observed on December 9th every year as a reminder for everyone within the corporate industry and beyond to actively speak out and fight against...

Read More

GDPR vs. UK-GDPR; the Laws Post Brexit

The General Data Protection Regulation (GDPR) is a regulation in EU law that was implemented on the 25th of May 2018 and concentrates on data protection and confidentiality in the European Union and the European...

Read More

Due Diligence and Compliance: Breakdown and Importance

DUE DILIGENCE VS COMPLIANCE Due diligence is a vital part of tackling anti-bribery & corruption in the workplace. The Corporate Financial Institute has defined it as a process of verification, investigation, or audit of a...

Read More

The Consequences of Neglecting Background Screening

Neglecting Background Screening Are you neglecting background screening? What consequences may affect your organisation when you ignore this process when hiring? What is it about Background Screening? Statistics have revealed to us that a substantial...

Read More

CRI™ to attend PBSA Mid-Year Legislative & Regulatory Conference 2022

Corporate Research and Investigations Limited (CRI Group™) is delighted to unveil our place at the 2022 PBSA Mid-Year Legislative & Regulatory Conference in Virginia, USA. The PBSA Mid-Year Legislative & Regulatory Conference is convened each...

Read MoreWEBINAR | Do you Know the Importance of the Whistleblowing Standard?

Whistleblowing is integral to an ethical and moral working environment and over the years, there have been many instances that have led to the loss of reputation, monetary gain and expansion for many corporations. A...

Read More

Fraud Prevention Strategy: Build One in Five Simple Steps

Fraud Prevention Strategy: The 5 Simple Steps A fraud prevention strategy is one of the key policies that can aid an organization in safeguarding itself against reprimands of the matter. One of the greatest encounters...

Read More

Anti-Money Laundering Services: Why Do Organisations Need it?

Anti-Money Laundering Services: Why do Organizations Need it? The Anti-Money Laundering (AML) service or check is a character and identity evaluation conducted on third-party members, such as investors, to certify that each third-party member is...

Read More

Time to get ISO 37001:2016 Certified – The Process, Part 2

Shifting a light on anti-Bribery and anti-corruption methods, our sister brand ABAC™ Centre of Excellence tells us how key is ISO 37001:2016 Anti-Bribery Management System Certification is for public, private, and non-profit organisations across the globe...

Read More

Time to get ISO 37001 Certified – The Process, Part 1

Shifting a light on anti-Bribery and anti-corruption methods, our sister brand ABAC™ Centre of Excellence tells us how key is ISO 37001:2016 Anti-Bribery Management System Certification is for public, private, and non-profit organisations across the globe...

Read More

CRI™ to attend 2022 Trade Winds Dubai, Gulf Region | March 6-8

2022 Trade Winds We are delighted to unveil our place at the 2022 Trade Winds As the largest annual U.S. government trade mission - meet with Corporate Research and Investigations Limited (CRI Group™). Trade Winds,...

Read More

Meet Samia El Kadiri; Gifted Consultant, Author & Trainer

CRI Group™ is delighted to welcome Samia El Kadiri as an Auditor at our sister brand the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence. Samia provides audit services and expertise on existing compliance and Anti-bribery Anti-corruption...

Read More

Employee Background Checks: A Requisite for all Businesses

Employee Background Check Concepts Employee Background check concepts are inescapable for your organisation if you are looking to minimise risks surrounding a bad hire. The concept of an employee background check has become one of...

Read More

What is Business Intelligence? Investigative Operations vs Intelligence Operations

What is Business Intelligence? What is Business Intelligence? How are Investigative operations are compared to Intelligence operations? Business Intelligence (BI) is a phrase coined for the analytical procedures an organisation commences. Business Intelligence is known...

Read More

Anti-Money Laundering (AML) Checks; The Lowdown

Anti-Money Laundering checks is a broad term applied to define checks conducted as a portion of the UK’s Anti-Money Laundering regulatory framework. An AML can be a check on a person carrying out a specialised...

Read More

Meet Zafar I. Anjum, Group CEO

Building a 34 years’ career in anti-corruption, fraud prevention, protective integrity, security and compliance, Zafar Anjum is a highly respected professional in his field. As a trusted authority in fraud prevention and securities among corporate...

Read More

Risk Management New Approach. All Explained in this Free Playbook!

Risk Management New Approach. All Explained in this Free Playbook! Risk management new approach. How do you manage risk? Managing risk effectively is essential to ensure businesses succeed and thrive in an environment of constant...

Read More

Risk Assessment Breakdown: Identification, Analysis, and Evaluation

Risk management is a full-time, ongoing endeavour for organisations in today's business world, and it poses constant challenges. Unfortunately, fraud, bribery and corruption are major factors affecting businesses and agencies of all sizes and industries....

Read More

WEBINAR | Breaking Down The ISO 37001 Audit Process

There is no "one-size-fits-all" method to the ISO 37001 Audit Process to achieve the anti-bribery management systems certification There's been much discussion surrounding ISO 37001:2016 Anti-Bribery Management Systems and the ways that attaining certification to...

Read More

Why Financial Services Firms Need ISO 37001 ABMS?

When Société Générale, a global financial services institution based in France, agreed to pay a combined total penalty of more than $860 million for an alleged bribery and corruption scheme, it served as a warning...

Read More

Common Fraud in the Pharmaceutical Industry Reported by Whistleblowers

Pharmaceutical Fraud Pharmaceutical fraud involves activities that result in false claims to insurers or programs such as Medicare in the US or equivalent state programs for financial gain to a pharmaceutical company. Several different schemes...

Read More

How Risky is Non-Compliance to Your Business?

How Risky is Non-Compliance to Your Business? Last year we saw our fair share of AML (anti-money laundering) failures and violations, resulting in eye-watering FCA and HMRC fines. According to Ponemon Institute and security company...

Read More

Inadequate Due Diligence Hit Space-Transport SPAC Momentus $8 Million SEC Fine

Inadequate Due Diligence Hit SPAC Momentus $8 Million SEC Fine Inadequate due diligence hit SPAC Momentus $8 million SEC fine after misleading investors. The Securities and Exchange Commission (SEC) has charged the Momentus particular...

Read More

To Check or Not to Check?

Background Checks: To Check or Not to Check? Background checks don’t tend to make international news. They are the low-key diligent step in most well-managed recruitment processes to comfort employers that the person they are...

Read More

How to Identify and Prevent Employee Fraud?

In 2017 the major European ABB conglomerate admitted that an employee took advantage of serious management failings to disappear with $103 million of the firm's cash. According to CNN business, ABB CEO Ulrich Spiesshofer and Chief...

Read More

Risks of Cybercrime and Social Media: NEW PLAYBOOK

The risks of cybercrime claims many victims over many sectors. The PwC Global Economic Crime Survey 2020 found that a company falls victim to six frauds on average. The most common types are customer fraud,...

Read More

New European Parliament Corporate Due Diligence and Corporate Accountability

Corporate due diligence and corporate accountability, ending an era of voluntary policing. A new EU mandate places liability on companies unable to assess and mitigate unethical third-party behaviour. New legislation requires companies operating in the EU...

Read More

John Wood Group to Pay $177 Million to Settle Bribery Charges Inherited Through its Merger

John Wood Group Bribery Probe Trace Back to its Merger with Amec Foster Wheeler Plc. John Wood Group Plc has agreed to pay $177 million to settle the UK led bribery and corruption probe into a...

Read More

Looking for a Service Provider Due Diligence Checklist?

Due Diligence Checklist Due diligence checklist and service provider. There are many risks implicit in doing business, and CEO's and risk management officers face many internal and external threats. Most organisations face preventable risks; however,...

Read More

ISO 37001 Solutions for All Industries (Part 3)

In part 1, we discussed how ISO 37001 ABMS can help companies across a wide range of industries, including automotive, aviation and insurance. In part 2, we looked at how pharma and healthcare, property, IT...

Read More

Procurement Risks: The 5 common Risks Every Organisation Needs to Know!

Procurement Risks: Your Lack of Due Diligence can Lead to Harm Procurement risks: lack of due diligence can lead to harm. Procurement is one of the most critical areas of any organisation, large or small....

Read More

Tackling Corporate Fraud in the Middle East

Tackling corporate fraud in the middle east has become even more challenging during the pandemic. ICAEW Insights sat down with our founder and chief executive, Zafar Anjum, to discuss the rising levels of corporate fraud...

Read More

5 Reasons To Run Employee Screening

Being HR professional, we have to deal with rigorous recruitment cycles, and for this, we must meet with several candidates before closing the vacancy. Every HR person has their style of evaluating the candidates, but...

Read More

CRI Group™ Celebrates World Accreditation Day

Accreditation has a positive impact on consumers, suppliers, purchasers, and regulators across industries and organisations all over the world. Proper accreditation and certification can demonstrate necessary expertise and training, and ensure quality and reputability. That’s...

Read More

Mubadala Petroleum Achieved ISO 37001 ABMS Certification Through CRI Group™

Corporate Research and Investigations Limited (CRI Group™) announced that Mubadala Petroleum, a leading international oil and gas company, has successfully achieved ISO 37001 Anti-Bribery Management Systems certification. The announcement was made by Zafar Anjum, CEO...

Read More

Background Screening Trends You Need To Know Now

COVID-19 has changed our lives significantly, changes are happening across all areas, and pre-employment background checking is no exception. Organisations worldwide have focused on ‘pandemic-proofing’ their employment background checks to ensure they pick the right...

Read More

The Story of Our CEO and Company

The Story of CRI Group™ By Zafar I. Anjum, Group CEO THE BEGINNING: EVENT THAT CHANGED ME Shortly after leaving the Pakistani Rangers in 1994 (five years after my graduation), I took over my father's...

Read More

CRI™ is Welcomed to the Association of Corporate Investigators (ACi)

The Association of Corporate Investigators (ACi) has approved the Corporate Research and Investigations (CRI Group™) as a member of its global community of investigators. CRI™ is now part of a global community that exclusively champions the...

Read More

How is COVID-19 Radically Transforming the New-Hire Experience

The COVID-19 pandemic has been a challenging time for industries, organizations and their teams on every level. HR leaders had to adapt to a new normal quickly. Along with coping with the closing of workplaces...

Read More

What’s Law vs Allowed with Pre-employment Screening Around the World:

Pre-employment Screening is a vital yet overlooked function in an organisation. Many organisations scale their businesses globally and into multiple countries simultaneously. The main reason as to why many business may opt to not run...

Read More

Q&A on How Corporate Fraud and Corruption Affect Businesses in the UAE 2021

CRI Group™ and its ABAC™ Center of Excellence were featured in Financier Worldwide's InDepth Feature: Corporate fraud and corruption 2021. In this edition, CRI Group's CEO Zafar Anjum and ABAC Group's Scheme Manager Huma Khalid talk...

Read More

Corporate Fraud and Corruption: Affect on UK Businesses in the 2021

CRI Group™ and its ABAC Center of Excellence were featured in Financier Worldwide's InDepth Feature: Corporate fraud and corruption 2021. In this edition, CRI Group's CEO Zafar Anjum and ABAC's Scheme Manager Huma Khalid talk...

Read More

BS 7858:2019 | The New Way to Mitigate Employee Risk During COVID-19

BS 7858:2019 Standard: A New Way to Mitigate Employee Risk During COVID-19 BS 7858:2019 Standard is the revised standard for screening individuals working in secure environments. The far-reaching impact of the COVID-19 outbreak has affected...

Read More

Cyber Security: How to Maintain GDPR Compliance?

The European Union’s (EU) General Data Protection Regulation (GDPR) came into force in 2018. The GDPR was a response to massive worldwide data breaches that were undermining the trust and security of private citizens whose...

Read More

What are the Stages of ISO 37001 Certification?

The ISO 37001:2016 Certification is an Anti-Bribery Management System Certification critical for organisations in the public, private and non-profit sectors. After all, consider the benefits: Certification adds a distinct level of credibility to the organisation’s...

Read More

Q&A: Corporate Fraud & Corruption in the UK 2021

The United Kingdom scores 77 out of 100 on Transparency International's (TI) 2020 Corruption Perceptions Index (CPI), as is one of the 25 least corrupt countries across the globe. However, it all seems great on...

Read More

The Consequences of Inadequate Due Diligence

Adequate Due Diligence Running worldwide businesses requires effectively recognizing, analyzing and managing risks and ensuring compliance. We have identified that many organizations with third-party relationships conduct inadequate due diligence that might pose significant risks. In...

Read More

Unemployment Insurance Fraud During COVID-19

The Financial Crimes Enforcement Network (FinCEN), a bureau of the United States Department of the Treasury that collects and analyses information about financial transactions in order to combat domestic and international money laundering, terrorist financing,...

Read More

Address Risk with Employee Background Checks

Employee Background Checks We have all heard of the term "employee background checks", but what is the exact function of this process? There are inherent risks in the hiring process, including fraudulent claims by candidates....

Read More

CPI 2020 Overview: Middle East & Asia

The newly published Transparency International’s Corruption Perception Index (CPI 2020) has ranked 180 countries and territories by their perceived levels of public sector corruption. This index uses a scale of 0 to 100, where 0...

Read More

Protecting Your Company from the Global Corruption Pandemic

Webinar Video | Protecting Your Company from the Global Corruption Pandemic Organizations now, more than ever, become vulnerable and have to take actions now to protect themselves, reputation, employees and other stakeholders from bribery and...

Read More

ESG: CRI Group™ Environmental Policy

Corporate Research and Investigations Limited “CRI Group™” is a certified member of GBB (Green Business Bureau), seeks excellence in every aspect of our business and is committed to minimising the environmental impacts of our business...

Read More

CRI®, the only company with BS102000 & BS7858 certifications in Middle East

What is BS7858 & BS102000? The BS7858:2019 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” places emphasis on the risk assessment of secure environment workers. The code focuses on the...

Read More

CRI® Group celebrates International Anti-Corruption Day

Wednesday the 9th of December marks the International Anti-Corruption day since the passage of the United Nations Convention Against Corruption on 31st October 2003. Based on AntiCorruptionDay.org, as the world is recovering from COVID-19 pandemic, this...

Read More

Q&A: Corporate Fraud and Corruption in UAE

The United Arab Emirates (UAE) is the 21 least corrupt nation out of 180 countries, according to the 2019 Corruption Perceptions Index reported by Transparency International. However, UAE corporate fraud and corruption still prevails as...

Read More

The Unseen Enemy: Insurance Fraud – Part III

This three-part series of articles examines the problem of insurance fraud, including its pervasiveness and general characteristics in the United States, the United Kingdom and the world. Insurance fraud is a widespread problem that requires...

Read More

Have you done your Corporate Compliance Programs Gap Analysis (HEBA) yet?

Prove that your business is ethical. Complete our FREE Highest Ethical Business Assessment (HEBA) and evaluate your current Corporate Compliance Program. Find out if your organisation's compliance program is in line with worldwide Compliance, Business...

Read More

ILO Monitor: COVID-19 and the world of work, 2nd update

ILO (International Labour Organization) has updated "ILO Monitor: COVID-19 and the world of work. Second edition". Since the first edition, the COVID-19 pandemic has further accelerated in terms of intensity and expanded its global reach. According to...

Read MoreCRI Group™ Celebrate 2021 International Fraud Awareness Week

CRI Group™ is once again a proud supporter of 2021's International Fraud Awareness Week. Taking place throughout the week of November 14th to November 20th of 2021, International Fraud Awareness Week is a global effort...

Read More

BS7858:2019 – everything you need to know and more!

The recent update of the BS7858 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” places emphasis on the risk assessment of secure environment workers. The code focuses on the need for tighter...

Read More

CRI® Proud Official Supporter of International Fraud Awareness Week 2020

International Fraud Awareness Week, November 14-20 – and CRI® Group is once again a proud Official Supporter of this global movement. Fraud Week was created to reduce the impact of fraud and corruption by promoting anti-fraud awareness...

Read More

Fraud in a wake of COVID-19 pandemic

COVID-19 continues to affect businesses in a myriad of ways. Organisations are having to adapt quickly to the fast-changing climate of the pandemic, and unfortunately, we've recently noticed some business practices of cutting steps in...

Read More

Debugging fears that paralyse fraud prevention

Debug fears for fraud prevention Even though companies understand the fraud risk factor - nearly 77 per cent of HR professionals accept that there is a risk that employees can initiate fraudulent activity because of the...

Read More

Don’t let the dominoes fall (ever) with our new TPRM certification…

CRI® Group is launching a third-party compliance verification and certification program - 3PRM-Certified™ - across the Middle East, Europe and Asian region. This Third-Party Risk Management (TPRM) program can help organisations establish the legal compliance, financial viability,...

Read More

CRI® Group Joins Movement to Shine a Spotlight on Fraud

2021 International Fraud Awareness Week kicks off November 14-20 worldwide. Fraud costs organisations worldwide an estimated 5 percent of their annual revenues, according to a study conducted by the Association of Certified Fraud Examiners (ACFE). The...

Read More

The Unseen Enemy: Insurance Fraud – Part II

This three-part series of articles examines the problem of insurance fraud, including its pervasiveness and general characteristics in the United States, the United Kingdom and the world. Insurance fraud is a widespread problem that requires...

Read More

Q&A: Corporate Fraud and Corruption in Pakistan

Corporate fraud and corruption in Pakistan is widespread (Rose-Ackerman, 1997, p. 4), particularly in the government and police forces. However by 2013 the country had improved by 12 indices compared to its previous rank – in...

Read More

Background Screening Survey: COVID-19 is Impacting HR

An overwhelming number of COVID-19 background screening survey respondents said that the COVID-19 pandemic is affecting human resources at their company. There are also concerns about fraud, and the protection of confidential information as a...

Read More

#InTheNews: Employee Background Screening

Macy’s Reaches Agreement in Lawsuit Involving Employee Background Screening ESR News reported that “an agreement has been reached in the case of The Fortune Society v. Macy’s brought under Title VII of the Civil Rights Act of 1964 and Fair...

Read More

Q&A: Corporate Fraud and Corruption in UK is Growing, FAST!

Corporate fraud and corruption is growing in United Kingdom (UK). In a devastating article, Oliver Bullough proved that UK is quickly becoming the money-laundering capital of the world. In addition, the most recent The Guardian article "If you...

Read More

ICC launches an Anti-corruption Third Party Due Diligence guide for small and medium size entities

International Chamber of Commerce (ICC) has launched an Anti-corruption Third Party Due Diligence guide for small and medium size entities. SMEs are often on the receiving end of burdensome due diligence procedures of large multi-national companies....

Read More

ISO 37001 Solutions for all industries (Part 2)

In part 1, we discussed how ISO 37001 ABMS can help companies across a wide range of industries, including automotive, aviation and insurance. In this part, we look at how pharma and healthcare, property, IT...

Read More

CRI Group™’s ABAC™ anniversary: 4 years of achievements

CRI Group™'s ABAC™ Center of Excellence Limited is excited to be celebrating the 4 years anniversary since its formation back in 2016. At ABAC™, we are committed to helping businesses fight bribery and corruption inside...

Read More

Third-party risk: how to survive in a brave new world?

Third party risk management, how to survive in a brave new world? Third party risk management. The Current Business Climate Requires a Review and Reassessment of Your Organisation's Third-Party Relationships. We won't soon forget the...

Read More

The Role of a Fraud Investigator

Fraud investigators are the front line of establishing the facts of suspected fraud or other unethical business behavior. A fraud investigator’s skillset and wide knowledge of fraud laws, evidence gathering and interviewing make them the...

Read More

Q&A session with our CEO: United Arab Emirates fighting Fraud and corruption

Middle east corruption is a threat to the world. The United Arab Emirates (UAE) is a land of complex extremes where fabulous wealth and supercars live right next to staggering poverty. This is generally a recipe for fraud and...

Read More

ISO 37001 Solutions for all industries (Part 1)

Organisations of all industries, from financial institutions to international energy companies, can gain distinct benefits from ABAC® Certification for ISO 37001:2016 Anti-Bribery Management System standard. The fact is, any company is potentially susceptible to bribery...

Read More

The Unseen Enemy: Insurance Fraud – Part I

This three-part series of articles examines the problem of insurance fraud, including its pervasiveness and general characteristics in the United States, the United Kingdom and the world. Insurance fraud is a widespread problem that requires...

Read More

9 ways COVID-19 impacted background checks

The COVID-19 pandemic has disrupted business as we know it. How is the crisis still affecting your organization? Are you still experiencing a temporary decline in hiring, or does hiring seem to be non-stop? No...

Read More

FAQ: Employment Screening

Want to know what red flags are most often found on résumés and employment applications? CRI® Group’s EmploySmart™ experts provided some statistics on their latest pre-and post-employment screening engagements, giving insights into where companies are...

Read More

Responsible Management and CEOs

As of 13 August 2020, COVID-19 has affected more than million people globally, including 744,385 deaths, reported to WHO. The virus has also had severe economic implications, leaving organizations facing a unique set of new challenges...

Read More

COVID-19 Prompted Innovative Leadership

As of 3 September 2021, COVID-19 has affected more than million people globally, including 218,580,734 deaths, reported to WHO. The virus has also had severe economic implications, leaving organizations facing a unique set of new challenges...

Read More

The Little Book of Big Scams by MET

The Little Book of Big Scams was released in 2012 by The Metropolitan Police Service's Operation and after its huge success the MET has released a new version. The Little Book of Big Scams is...

Read More

FTC Guide for Small Business to Avoid Scams

Federal Trade Commission (FTC) has released a guide for small business. Scams & Your Small Business guide is part of FTC’s efforts to help small business owners to avoid scams. If you are a small...

Read More

Banking industry squad prevents £20m of fraud

Banking industry squad disrupted 23 Organized Criminal Groups (OCGs) preventing £20 million of fraud. The specialist police unit (DCPCU) is funded by the finance and banking industry in a dedicated effort to stop fraud. Commonly known as the banking industry squad,...

Read More

7 Traits of a Resilient Leader

Every successful leader has encountered a challenging scenario at some point in their career. The unprecedented COVID-19 pandemic, however, has forced leaders to face unforeseen new challenges. With the pandemic’s colossal impact on operations, workforces,...

Read More

Fraud Advisory Panel deep dives into the HBOS scandal

On 30 January 2017, following a four-month trial, former HBOS employees Scourfield and Mark Dobson involved in HBOS scandal were convicted of fraud and corruption involving a scheme that cost the bank £245m. Scourfield pleaded guilty to...

Read More

Background Screening Red flags: Numbers Don’t Lie

Want to know what types of red flags are most often found on résumés and employment applications? CRI® Group’s EmploySmart™ experts provided some statistics on their latest pre- and post-employment screening engagements, and they give...

Read More

COVID19 increases identity theft cases: 7 steps to lessen your risk

What does an embezzler spend their money on? In the case of a New York man’s alleged fraud, just about everything, apparently. According to IDentutyUSA identity theft is on the rise during COVID-19 pandemic. Experts predict...

Read More

Challenges for Background Screening Service APAC Providers

According to Investor’s Globe – a unified hub for information and ideas relating to investment – Asia Pacific (APAC) is the fastest growing economic region of the world and investors’ top choice. Further, in a...

Read More

TPRM: When is it time to conduct third-party screening?

When to conduct third-party screening? Why do organisations screen their employees but not the companies they work with? Failing to screen third-party screening to the same level as permanent staff will increase your risks on...

Read More

Fraud Advisory Panel UK counter fraud 2019 report is out!

Fraud poses a major threat to the UK and the world. The slow progress in fighting fraud in 2019 was evident to all of us with the never-ending stream of news stories documenting bribery and corruption cases around the...

Read More

Fraud Advisory Panel have set up a COVID-19 fraud watch group

The Fraud Advisory Panel have set up a COVID-19 fraud watch group. A cross-sector and cross-industry coalition of trusted partners (including the Cabinet Office and City of London Police) who meet weekly to share information...

Read More

COVID-19: Background Screening More Critical Than Ever

The COVID-19 pandemic is fundamentally affecting the world and businesses. In this time of crisis, businesses have to adapt quickly to survive, which sometimes means cutting costs and steps in various business processes, including hiring...

Read More

COVID-19’s impact on Cyber security: is your team safe?